Despite a downbeat end of the year, which saw the S&P 500 slip 3.4 percent from its early December high, 2024 was yet another great year for U.S. stocks overall. Against a backdrop of robust economic growth, a stable labor market and cooling inflation, which enabled the Fed to start cutting rates in September, it was the ongoing AI boom that carried much of the momentum throughout the year. The S&P 500 ended 2024 up 23.3 percent, while the tech-heavy Nasdaq Composite index gained almost 30 percent and the Dow Jones Industrial Average recorded a more modest 13 percent increase.

And while 2024 marked the fourth year of 20+ percent gains in the past six years for the S&P 500, such returns shouldn’t be taken for granted. In fact, 2023 and 2024 were the first back-to-back years where the S&P 500 gained more than 20 percent in two and a half decades. From 1995 to 1998, the index even clocked four consecutive years of 20+ percent gains plus another 19.5-percent increase in 1999. That long-time rally was followed by the bursting of the dot-com bubble in 2000, however, which resulted in three consecutive down years of the S&P 500.

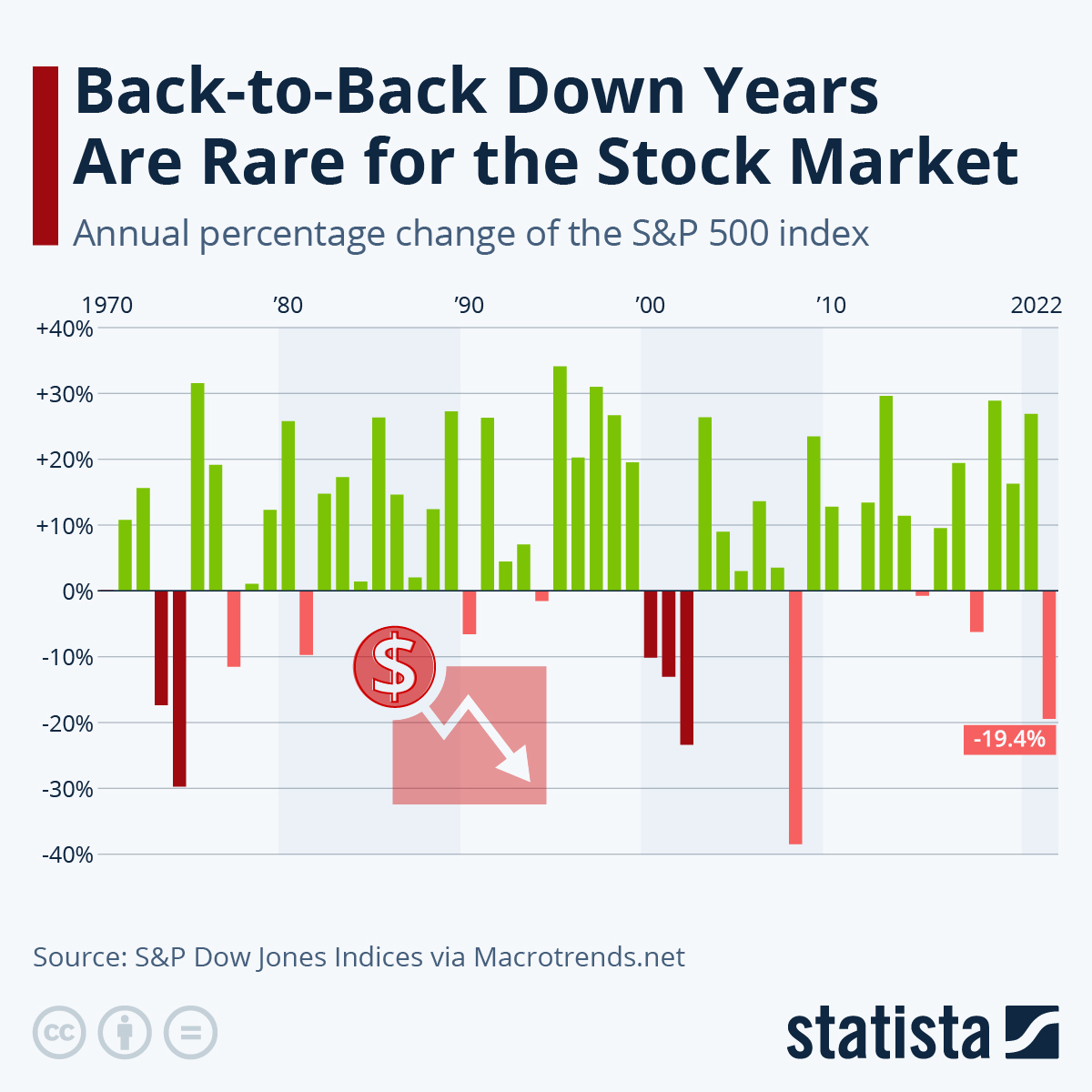

Thankfully, back-to-back down years are a very rare occurrence, as our chart shows. According to Macrotrends.net, the S&P 500 has only seen consecutive years of negative returns three times since 1957, in 1973/1974 and in 2001/2002/2003 with returns getting worse in the second (and third) down year on each of those occasions. Since 1957, the S&P 500 has ended the year in the red 18 times including 2022. 15 times out of 18, the index returned to growth the next year.