On the surface, last week’s advance GDP estimate, which showed an 0.3 percent contraction of U.S. economic output in the first three months of 2025, fed into the recession fears that have gripped the United States ever since President Donald Trump dove head-first into a new trade war. After all, hadn’t many economists warned that the new tariffs would hurt the American economy and ultimately cause a recession?

Well yes, but not so fast. While the disappointing GDP reading was in fact caused by tariffs or the fear thereof, it wasn’t their damaging impact on consumer spending or private investment that caused the contraction. Instead, it was a steep increase in imports in anticipation of upcoming tariffs that drove the GDP decline. As imports are a subtraction in the calculation of GDP, a surge in imports actually hurts GDP growth, even if only in the short run.

As businesses were anticipating new tariffs, they stocked up on goods and inputs sourced abroad to avoid the levies. Once those products are sold in the U.S., they are counted as personal consumption expenditure, however, at which point their negative effect on GDP will be negated. As the U.S. Federal Reserve explained in a blog post in 2018, imports are merely an accounting variable in the calculation of GDP and the purchase of imported goods and services has no direct negative impact on U.S. GDP.

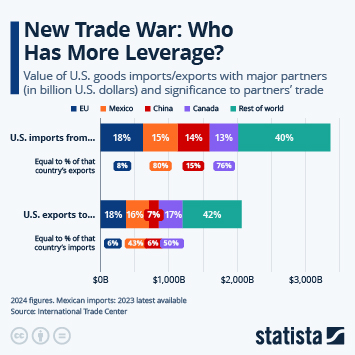

With that in mind, last week’s GDP reading doesn’t look as bad it did at first glance. As our chart shows, the impact of U.S. companies front-loading imports in anticipation of new tariffs more than offset the positive contributions from consumer spending and private investment, which together account for 87 percent of U.S. GDP. As the BEA noted, real final sales to private domestic purchasers, i.e. the sum of consumer spending and private investment, increased 3.0 percent in the first quarter in a clear sign that domestic demand remained robust ahead of the tariff impact.